- A new study shows that the wealthy have far more influence than the average American

- Julian Zelizer says study raises disturbing questions about power of campaign money

- If wealthy shape policy, the inequality divide in America will only get worse, he says

- Zelizer: It may take a constitutional amendment, and state action, to reform system

Editor's note: Julian Zelizer is a professor of history and public affairs at Princeton University. He is the author of "Jimmy Carter" and "Governing America." The opinions expressed in this commentary are solely those of the author.

(CNN) -- American democracy faces a very real threat. The power of money is overwhelming the power of average voters to influence government decisions. While this is an old lament in politics, social scientists are now finding very concrete proof about the damage being done.

The problem revolves around the way in which we fund our political campaigns. Opponents of campaign finance reform are having a field day. Over the past few years, they have watched with delight as the political parties and Supreme Court have slowly eviscerated the Watergate-era campaign finance reforms.

When the Supreme Court issued decisions citing constitutional barriers to the regulation of campaign finance and independent organizations have figured out new ways to influence politicians, opponents of reform proclaim that the system is better off. At a minimum, they argue that money and lobbying has always been part of this nation's politics: There is nothing much to do about it and the republic has survived.

Their arguments ignore the horrendous consequences that the influence of private money has on our democratic system.

The opponents of reform turn a blind eye toward the substantial evidence of how the nation is creating an unequal playing field that leaves many citizens virtually disenfranchised even when they retain the precious right to vote. Policies such as the tax system are skewed toward wealthier Americans, thereby worsening the cycle of inequality from which the nation can't seem to escape. As Elizabeth Warren recounts in her new book, the big banks had overwhelming influence as policymakers handled the crash of 2008.

At the most obvious level, the constant stories about the influence of money and lobbyists fuel public skepticism about the democratic process. The disillusionment caused by the role of money in politics discourages political participation.

But the effects are even worse than we might think. In an academic article that will make heads turn, the political scientists Martin Gilens (Princeton) and Benjamin Page (Northwestern) have found that as a result of our political processes, wealthier Americans have disproportionate influence on the kinds of public policies the government enacts. Average citizens matter, but only when they are in agreement with wealthier Americans. If not, they tend to lose.

Sen. Warren: The game is rigged

Sen. Warren: The game is rigged  Obama: Pay inequality's an embarrassment

Obama: Pay inequality's an embarrassment  The fight to close the wage gap

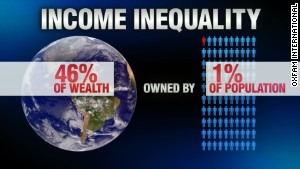

The fight to close the wage gap  Oxfam: $110 trillion owned by top 1%

Oxfam: $110 trillion owned by top 1%  What causes income inequality in the U.S.?

What causes income inequality in the U.S.? Based on a sizable database of public opinion and a study of 1,779 policy initiatives over 20 years, Gilens and Page report that a majority of Americans have little or no influence on the kinds of policies that the government produces. "When a majority of citizens disagrees with economic elites and/or with organized interests, they generally lose." Because of the way our system works, wealthy interests have the ability to block changes that they oppose.

Wealthy interests were almost 15 times as likely to obtain their preferences from policymakers on issues like tax policy as were ordinary citizens.

This is the culmination of changes that have been taking place for several decades. The mobilization of business interests and wealthier Americans accelerated in the 1970s after the role of the federal government had expanded.

As Paul Pierson and Jacob Hacker showed in their outstanding book, "Winner Take All Politics," the strengthening and thickening of the organization of the corporate and financial communities in Washington resulted in highly sophisticated lobbying operations and campaign donation techniques that enhanced their ability to influence policymakers.

Over the next few decades, the result was congressional decisions such as regressive tax cuts that favored wealthier Americans (starting with Ronald Reagan's 1981 tax cut) and economic deregulations that have favored their interests, such as freeing up the financial sector in the 1990s.

At the same time that wealthier interests were mobilizing to fight against campaign finance regulations put into place after Watergate, presidential candidates in both parties, including George W. Bush (in 2000, for the primary elections) and Barack Obama (in 2008, for the general election), ultimately decided to reject the publicly financed campaign system that had required them to accept spending limits.

The political parties introduced new mechanisms, such as soft money, to get around regulations while the Supreme Court dismantled the 1974 reforms through a series of historic decisions.

One of the most damaging results of these changes has been that the political benefits flowing to those with greater financial means worsens the economic inequality that has become such a defining part of modern times.

These kinds of findings should be shocking to Americans and offer more than enough evidence about the dangers we are unleashing through the continued dismantling of the campaign finance laws and the failure to impose serious regulations on lobbying.

For all the arguments about free speech and the need to compete, we should take a close look at a political system in which most Americans don't have a voice in the process and where, even worse, the outcomes are biased toward certain segments of the nation who can pay to play. This is one issue where the left and right, as well as the slim center, can find agreement.

Given Supreme Court decisions such as FEC v. Citizens United and FEC v. McCutcheon, a constitutional amendment might be necessary if there is to be any possibility of limiting contributions and spending. In the meantime, states might become the central arena for experimenting with new reforms.

Unless reform takes place, Gilens and Page have shown us that the nation is allowing money to slowly undercut the democracy that built America.

Follow us on Twitter @CNNOpinion.

Join us on Facebook/CNNOpinion.

In the early 20th century, industrial tycoons like the Rockefellers and Carnegies amassed fortunes in railroads, steel or oil. Here, a view of Cornelius Vanderbilt's residence in New York in 1908.

In the early 20th century, industrial tycoons like the Rockefellers and Carnegies amassed fortunes in railroads, steel or oil. Here, a view of Cornelius Vanderbilt's residence in New York in 1908.  Wealthy passengers aboard a ship near San Francisco, circa 1910s. In this era, the top earners accounted for roughly 18% of the national income.

Wealthy passengers aboard a ship near San Francisco, circa 1910s. In this era, the top earners accounted for roughly 18% of the national income.  People gathered across from the New York Stock Exchange on "Black Thursday," October 24, 1929. The stock market crash of 1929, fueled by excessive speculation on Wall Street, set off the Great Depression.

People gathered across from the New York Stock Exchange on "Black Thursday," October 24, 1929. The stock market crash of 1929, fueled by excessive speculation on Wall Street, set off the Great Depression.  Thousands of unemployed people waited in line to register for federal relief jobs in New York in 1933. The unemployment rate rose to 25% that year.

Thousands of unemployed people waited in line to register for federal relief jobs in New York in 1933. The unemployment rate rose to 25% that year.  On September 12, 1935, Franklin D. Roosevelt and his staff met to find a solution to the economic crisis. FDR's New Deal policies tightened regulation of Wall Street, strengthened unions and set the top marginal tax rate for the rich at 90%.

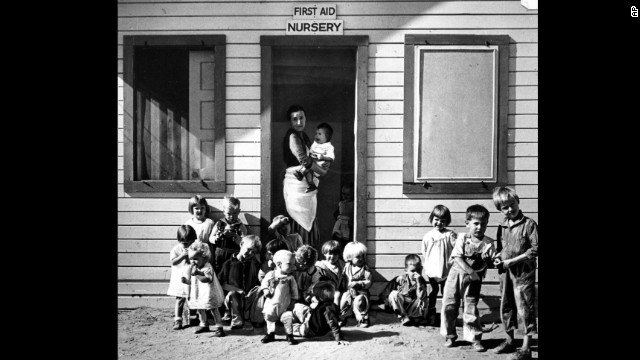

On September 12, 1935, Franklin D. Roosevelt and his staff met to find a solution to the economic crisis. FDR's New Deal policies tightened regulation of Wall Street, strengthened unions and set the top marginal tax rate for the rich at 90%.  A nurse takes care of children of migratory farm workers in Arvin, California, in 1937. The unemployment rate hovered in the teens. FDR created large-scale public work programs to provide jobs for the poor and middle class.

A nurse takes care of children of migratory farm workers in Arvin, California, in 1937. The unemployment rate hovered in the teens. FDR created large-scale public work programs to provide jobs for the poor and middle class.  A plant in Toledo, Ohio, that made bombs. With the advent of World War II, demand for production of goods and services increased. By the mid-1940s, the unemployment rate dropped to less than 5%.

A plant in Toledo, Ohio, that made bombs. With the advent of World War II, demand for production of goods and services increased. By the mid-1940s, the unemployment rate dropped to less than 5%.  Labor unions benefited from FDR's policies and grew in power midcentury. Transit workers protested in New York on April 17, 1950. The Transport Workers Union threatened a strike if even one worker was punished for demonstrating.

Labor unions benefited from FDR's policies and grew in power midcentury. Transit workers protested in New York on April 17, 1950. The Transport Workers Union threatened a strike if even one worker was punished for demonstrating.  Truck supervisor Bernard Levey with his family in front of their new home in 1950. The post-war period was a prosperous time for middle-class Americans.

Truck supervisor Bernard Levey with his family in front of their new home in 1950. The post-war period was a prosperous time for middle-class Americans.  From the 1950s to the 1970s, income inequality fell. Some economists call this period "The Great Compression." The median income at the time allowed a single earner to purchase a modest house and a car, support a wife and three children.

From the 1950s to the 1970s, income inequality fell. Some economists call this period "The Great Compression." The median income at the time allowed a single earner to purchase a modest house and a car, support a wife and three children.  A worker at the Department of Motor Vehicles in Sacramento, California, in 1966. The feminist movement fought for equal pay for women, who were earning about 60 cents for every dollar earned by men.

A worker at the Department of Motor Vehicles in Sacramento, California, in 1966. The feminist movement fought for equal pay for women, who were earning about 60 cents for every dollar earned by men.  In the 1970s, income inequality began to rise. The economy experienced wage and inflation problems, along with an oil crisis that caused a gasoline shortage. Here, a gas station in New York.

In the 1970s, income inequality began to rise. The economy experienced wage and inflation problems, along with an oil crisis that caused a gasoline shortage. Here, a gas station in New York.  Post-1979 has been called the "Great Divergence." Some say that President Ronald Reagan's policy of supply-side economics, which reduced taxes for the rich, was a contributing factor.

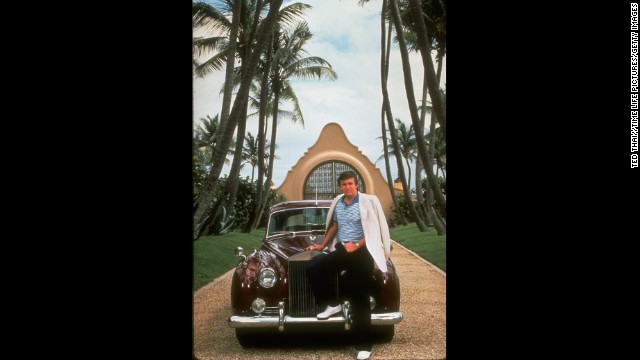

Post-1979 has been called the "Great Divergence." Some say that President Ronald Reagan's policy of supply-side economics, which reduced taxes for the rich, was a contributing factor.  Real estate tycoon Donald Trump with his Rolls Royce at his Mar-a-Largo property in Palm Beach, Florida.

Real estate tycoon Donald Trump with his Rolls Royce at his Mar-a-Largo property in Palm Beach, Florida.  The 138-meter (453-foot) yacht "Rising Sun" was purchased by Larry Ellison of Oracle, who has been one of the nation's highest-paid executives. From the 1990s on, CEO compensation greatly outpaced the average compensation of workers.

The 138-meter (453-foot) yacht "Rising Sun" was purchased by Larry Ellison of Oracle, who has been one of the nation's highest-paid executives. From the 1990s on, CEO compensation greatly outpaced the average compensation of workers.  Home construction in Inverness, Illinois, in 2006. Risky mortgage lending was packaged by banks that sought to make big profits. The collapse of housing bubble instigated a credit crisis that triggered the global financial meltdown of 2007.

Home construction in Inverness, Illinois, in 2006. Risky mortgage lending was packaged by banks that sought to make big profits. The collapse of housing bubble instigated a credit crisis that triggered the global financial meltdown of 2007.  By 2007, the top 1% accounted for 24% of national income. Bernard Madoff, whose Ponzi scheme is one of largest financial frauds in history, made billions off hapless investors. Here, shoes that once belonged to Madoff.

By 2007, the top 1% accounted for 24% of national income. Bernard Madoff, whose Ponzi scheme is one of largest financial frauds in history, made billions off hapless investors. Here, shoes that once belonged to Madoff.  Lehman Brothers, which collapsed in September 2008, filed for the largest bankruptcy in U.S. history. Major financial institutions were bailed out by the government with a massive amount of taxpayer money.

Lehman Brothers, which collapsed in September 2008, filed for the largest bankruptcy in U.S. history. Major financial institutions were bailed out by the government with a massive amount of taxpayer money.  John Thain, former CEO of Merrill Lynch, doled out more than $4 billion in bonuses to employees. Despite the worst economic crisis since the Great Depression, Wall Street handed out $18.4 billion in bonuses for 2008, which is the "sixth-largest haul on record."

John Thain, former CEO of Merrill Lynch, doled out more than $4 billion in bonuses to employees. Despite the worst economic crisis since the Great Depression, Wall Street handed out $18.4 billion in bonuses for 2008, which is the "sixth-largest haul on record."  A job fair in March 2009. Unemployment rose to 10% during the Great Recession.

A job fair in March 2009. Unemployment rose to 10% during the Great Recession.  In September 2011, the Occupy Wall Street movement sprang up. The average income, adjusted for inflation, grew $59 from 1966 to 2011 for the bottom 90% of Americans.

In September 2011, the Occupy Wall Street movement sprang up. The average income, adjusted for inflation, grew $59 from 1966 to 2011 for the bottom 90% of Americans.  Occupy Oakland protesters in California. In 2012, the income of the top 1% increased nearly 20% compared with a 1% increase for 99% of Americans.

Occupy Oakland protesters in California. In 2012, the income of the top 1% increased nearly 20% compared with a 1% increase for 99% of Americans.  A suite at the Four Seasons Hotel in New York City costs $45,000 a night. Middle class Americans had a median household income of a little over $51,000 in 2013.

A suite at the Four Seasons Hotel in New York City costs $45,000 a night. Middle class Americans had a median household income of a little over $51,000 in 2013.  Today, the top 1% controls about 40% of national wealth. At a hearing in Washington D.C. about Wall Street and the financial crisis, protesters hold a placard depicting Goldman Sachs CEO Lloyd Blankfein, who once famously said, "I'm doing God's work."

Today, the top 1% controls about 40% of national wealth. At a hearing in Washington D.C. about Wall Street and the financial crisis, protesters hold a placard depicting Goldman Sachs CEO Lloyd Blankfein, who once famously said, "I'm doing God's work."

No comments:

Post a Comment